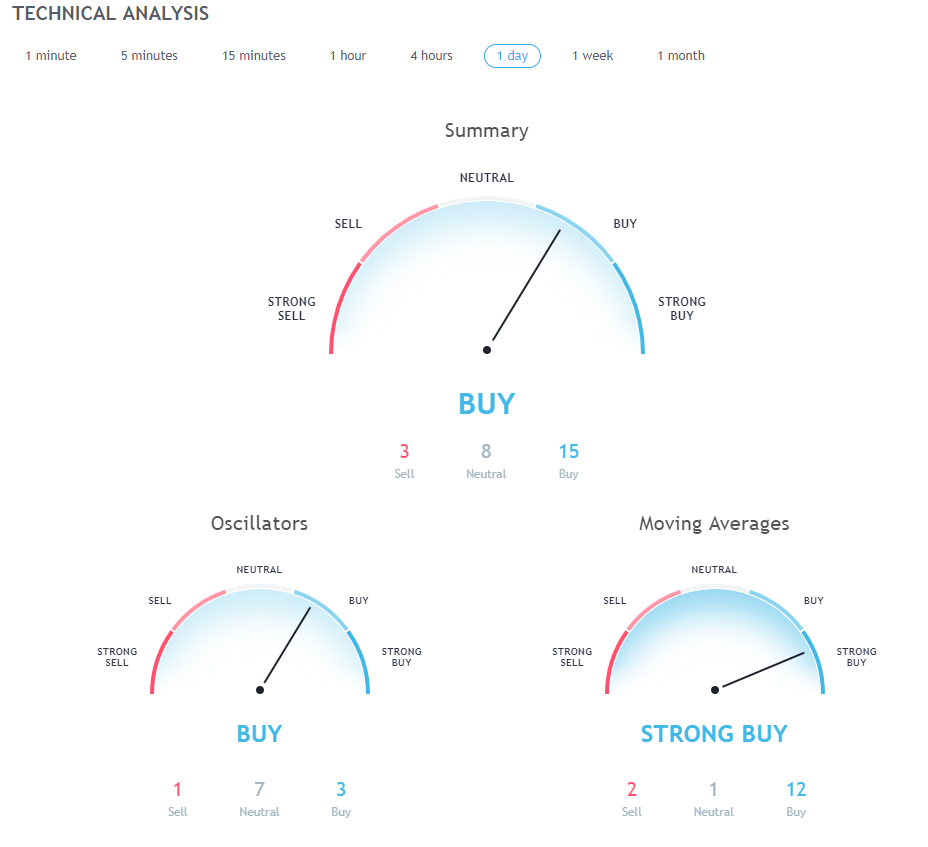

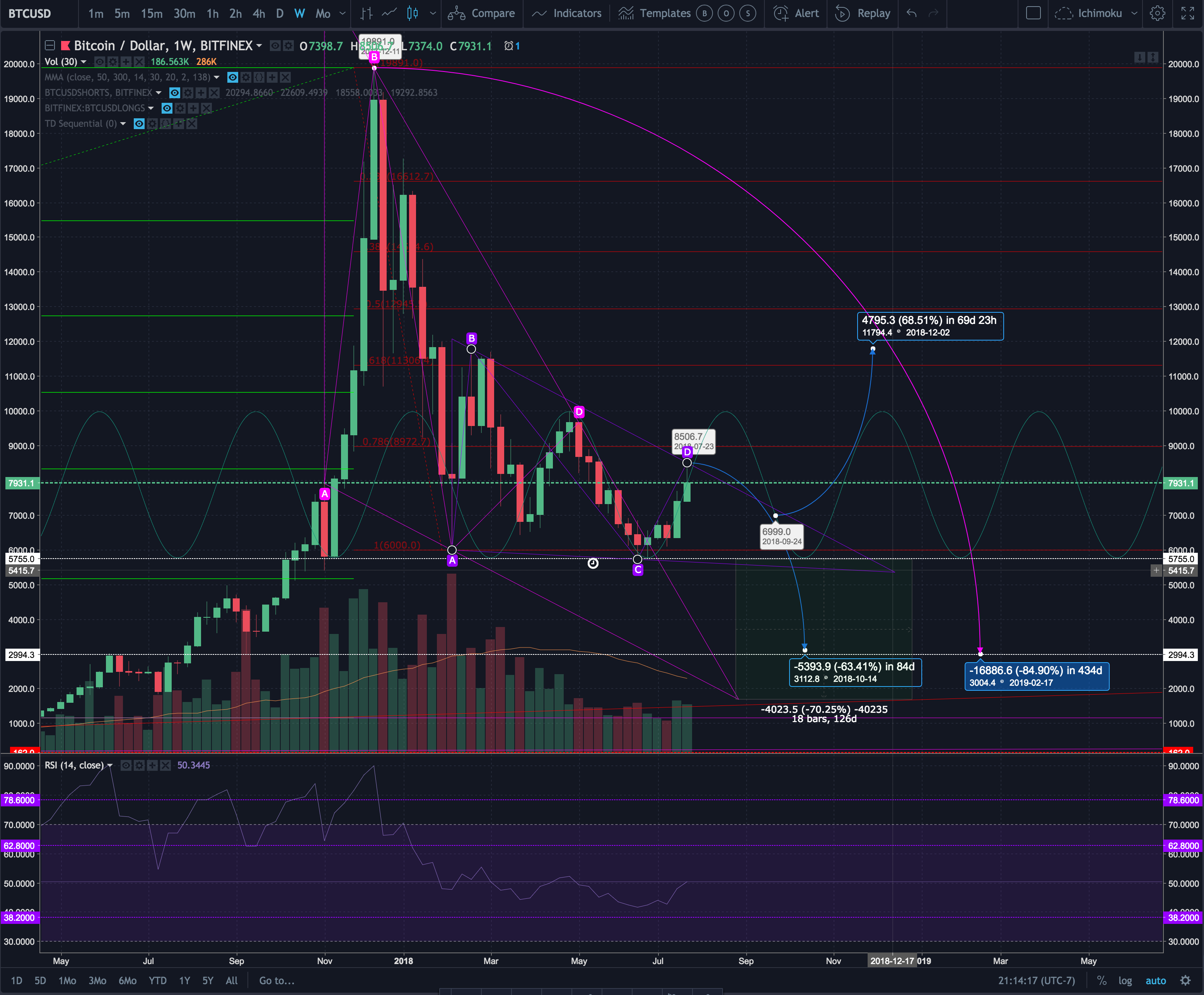

There will always be people attempting to predict the markets. This is not only the case of cryptocurrencies, but something that reflects across all of them. The techniques used are widely studied by people who want to participate of these markets, but mastering them I’m convinced is highly improbable. As much as it may be correct to say that analysts are more right than wrong, but for a really long time I’ve been trying to think exactly why that is the case.

What I’m attempting to express is hardly complicated. All the technical aspects used to read charts, the RSI, the moving averages, the bullish flag, etc. Might be attempting to predict market sentiment, the reaction of investors and not so much the asset’s value being traded. In other words, an unspoken agreement is made between those who are looking at the charts and a majority of investors jump in at the point of maximum agreement.

I’m thinking of this because this says very little about the value of an asset. If you were to think logically about the value gasoline for that matter. I doubt your way of looking at its value would be to attempt to predict if others would be willing to pay the same price for the gallon. You know you need it, you know it’s going to be used, so you simply purchase it.

If you are wondering why this is relevant to me or why I’m thinking about this today. Well, that is because I think a token like Steem is very close to becoming a usable asset and leave its days of exclusive speculation behind. The way I understand the upcoming SMT’s are going to give Steem the much needed boost it deserves.

I’m aware some might disagree with me on this matter, but I’m willing to backup my claims. An exclusive speculative market is extremely vulnerable to short term sentiment. If someone is speculating on Steem for example, that speculator is hardly interested in the long term valuation and a lot more in the short to medium profits to be made. This in turns gives Steem its current volatility making it harder for Long term investors to make the leap.

I’m saying this not because I believe speculation is a bad thing. In every single market in existence speculators are what give assets their liquidity thus making them an extremely important element of the ecosystem. But a healthy asset class, and more specifically a healthy asset’s value should probably not be exclusively derived from speculation.

Since it seems a little obvious to me at the moment that the speculative market is mainly driven by market sentiment, it’s also obvious that if someone would want to do something to improve the value of an asset, that contribution should be focused on improving sentiment. In other words, a positive representation of the asset, a proposed application, a working product.

On these respects Steem has a huge advantage over other assets on the cryptocurrency world and as such remains a blockchain no investor could really dismiss lightly.

I remain positive about the future of Steem as I believe it’s right on the brink of a huge transformative transition. @steemitblog has been extremely active keeping us informed. Something I’m told is fairly new, and it’s quite possible SMTs will launch before years end.

I hope many here remain positive and not allow fear to dominate. There is a lot of track before the true take off.