Hi traders, today I'd like to share my opinions regarding the broader market.

Bitcoin.

- On the daily time frame, Bitcoin looks primed to pop, we're squeezing hard against this low volume area of resistance on decent volume so I wouldn't be surprised if we produced another leg up to to hit $8100 before correcting to $7800 or so:

... failure to gather enough momentum to break out would probably send us back to retest $7300 over the next couple of days though:

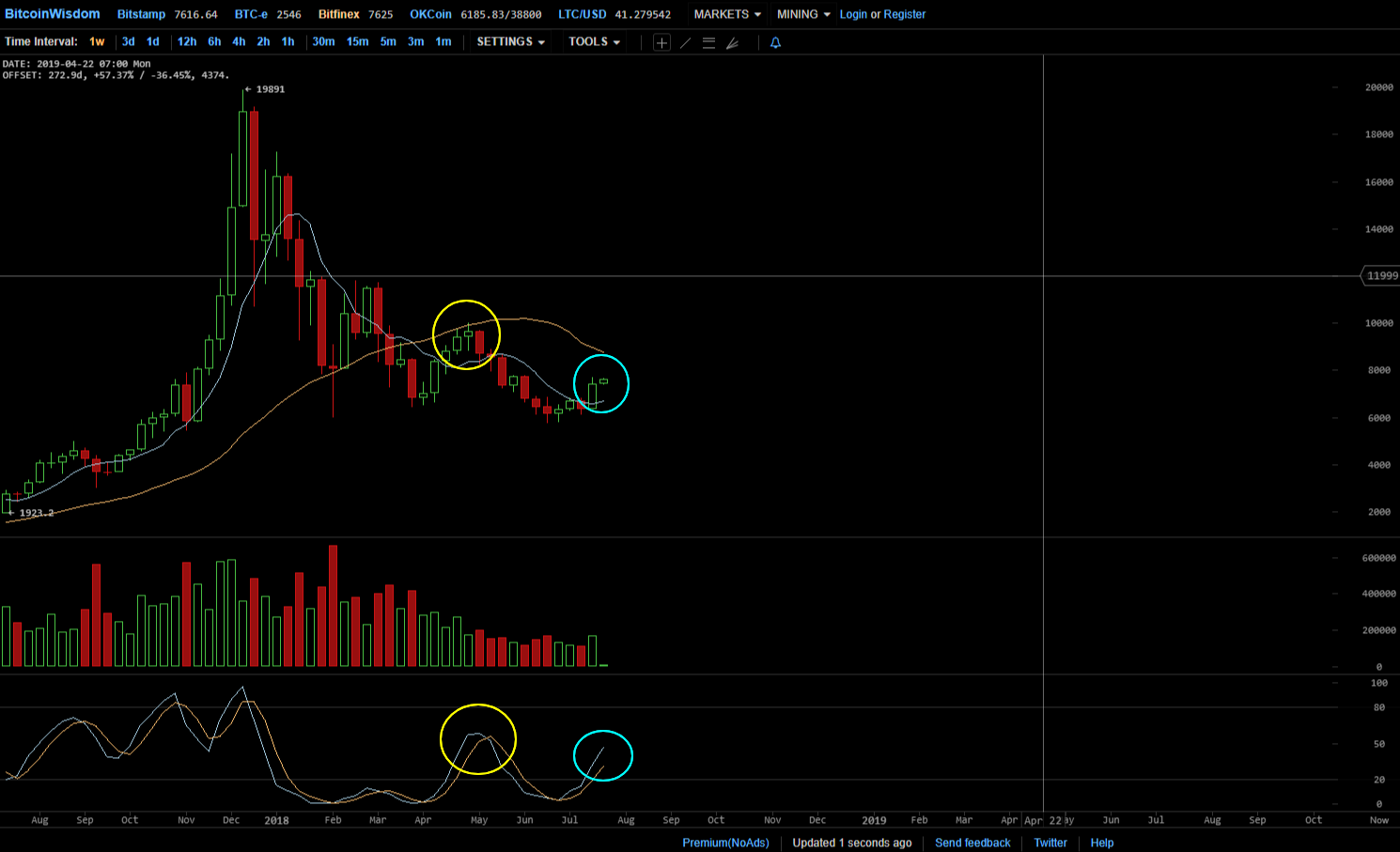

- It's on the bigger picture that things are getting interesting:

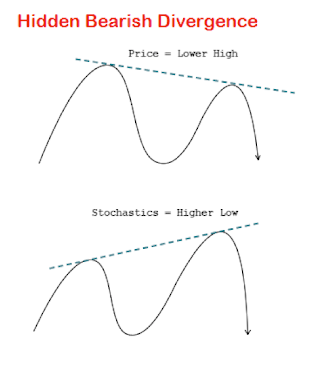

- As you can see on the chart above, we might be in the process of forming a hidden bearish divergence on the weekly chart. If you're unfamiliar with bearish divergences, those are high probability patterns that look like this:

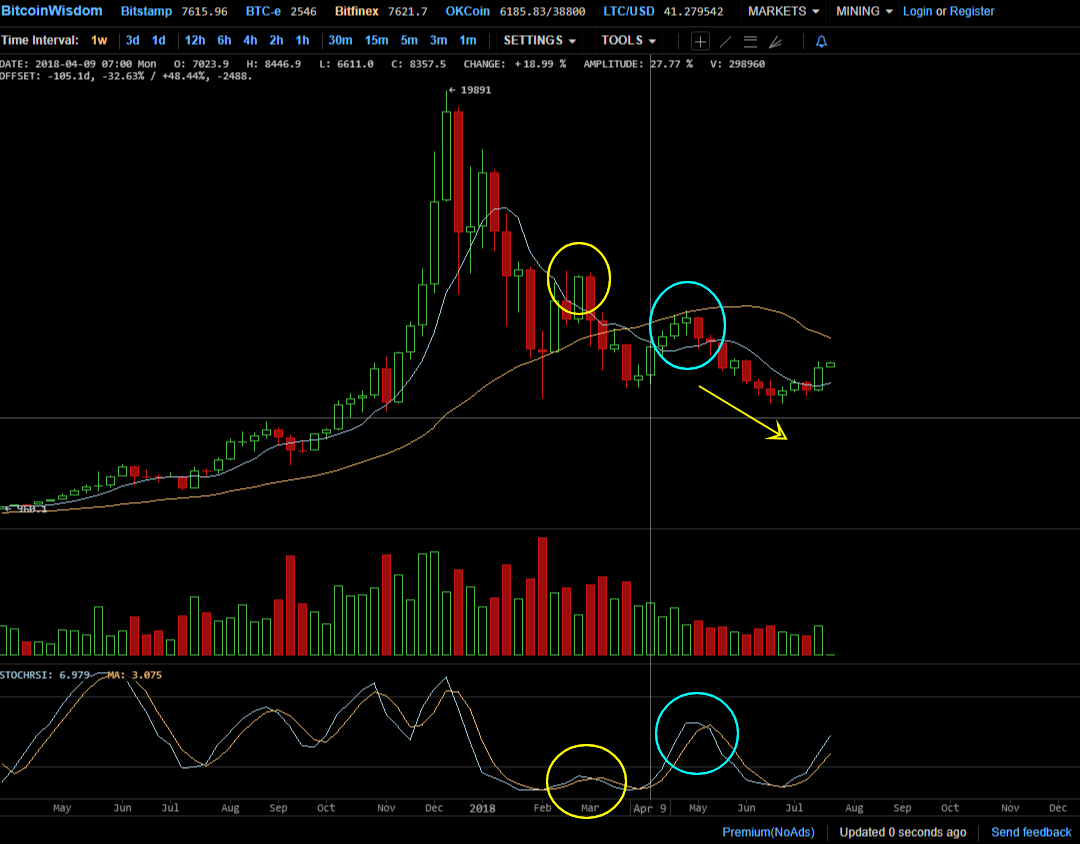

- The last time we had such divergence this happened:

... see what I am getting at here?

- Now, I am not saying that the divergence will form, the price could rally higher than 10k on the announcement of a Bitcoin ETF and completely invalidate the pattern:

... however I might start to get worried if something like this happens:

In my humble opinion, this type of price action would be a clear sign that we've reached a local top and that a deep correction is brewing. How big would the correction be? Well, my gut feeling tells me that we could very well come to retest $6000 or even $5700 but, given the market's overall bullish fundamentals, I doubt we would be able to gather enough momentum to break below $5700 and establish a lower floor.

What about you traders, how do you feel about the overall market? Do you think we're headed to break above $10k or do you think a dead-cat bounce is more likely?

If you liked this article, make sure to go check my featured reviews with @deanliu. Our latest posts are about the Aragon project, a neat DAO project on Ethereum and the Kyber Network, a great and user-friendly decentralized crypto exchange which allows you to trade directly from your hardware wallet.

0 comments:

Post a Comment