Regular daily update on BTC ta analysts opinions.

My summary - short-term (next 24h) sentiment: bullish(last: bullish)

- We are consolidating at the 7'350 level

- RSI on daily is getting close to oversold.

- RSI on 4hr is strongly oversold.

- Next major resistances are 7'664 (MA128 daily), 7'780 (Mid line Bollinger Bands weekly) and 8'280 (MA50 weekly).

- It seems in the war of the bears and bulls we are entering another battle: Can the bulls create enough FOMO to create distance to the lows and overcome major resistance levels? If so we are not going to see the current levels for a long time.

- Or do the bears lead the bulls into a trap and than smashing hard to the downside. That would create a lot of frustration and might lead to the capitulation which you would expect to be necessary to call the bear market over.

For now:

- I expect a pull back but than a continuation of the bull move.

Bull scenario*:

- We made a new higher high.

- We smashed through strong resistance zone at 6'800

- Next will be to make another higher low.

- Get through 7'800 resistance.

- Volume needs to increase.

- We go towards the 30/50 week MA and break above it.

Bearish scenario*:

- We move up for one or two weeks into the death cross (30 and 50 MA weekly) at around 8'500 and than drop significantly.

- Alternate - bears are turning after the RSI gets oversold an make a lower low

- After breaking 5'800 a significant drop towards new lows in the range of 4'975 and 4'300.

*scenarios based on daily-candles - so around 4-14 days timeframe. See also definition section

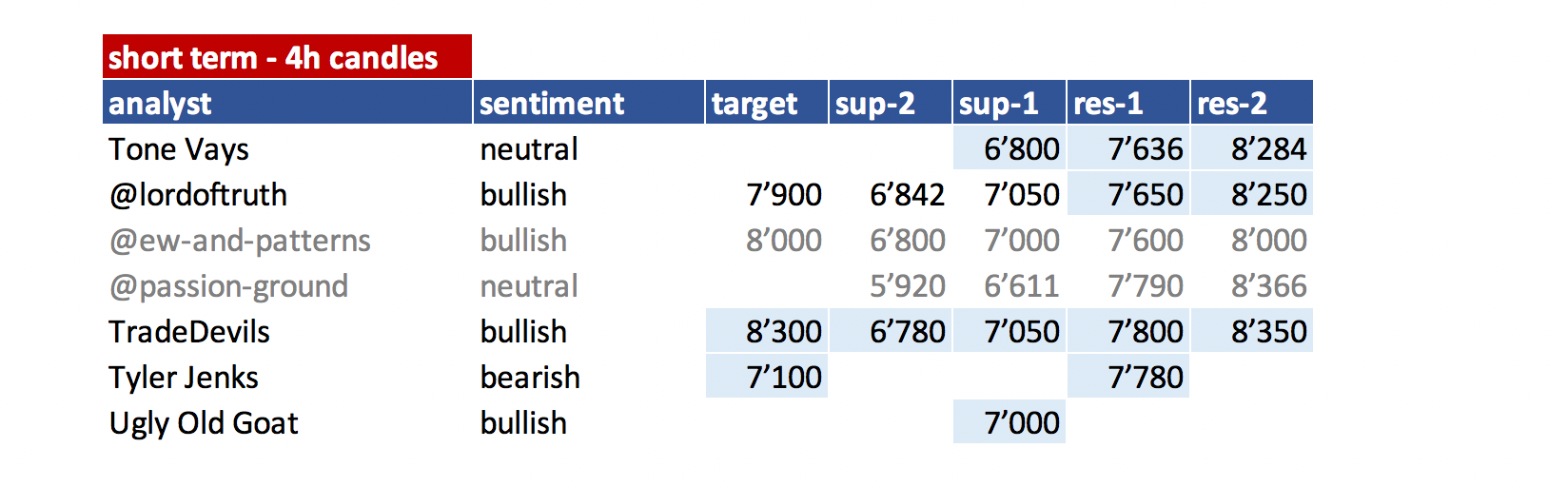

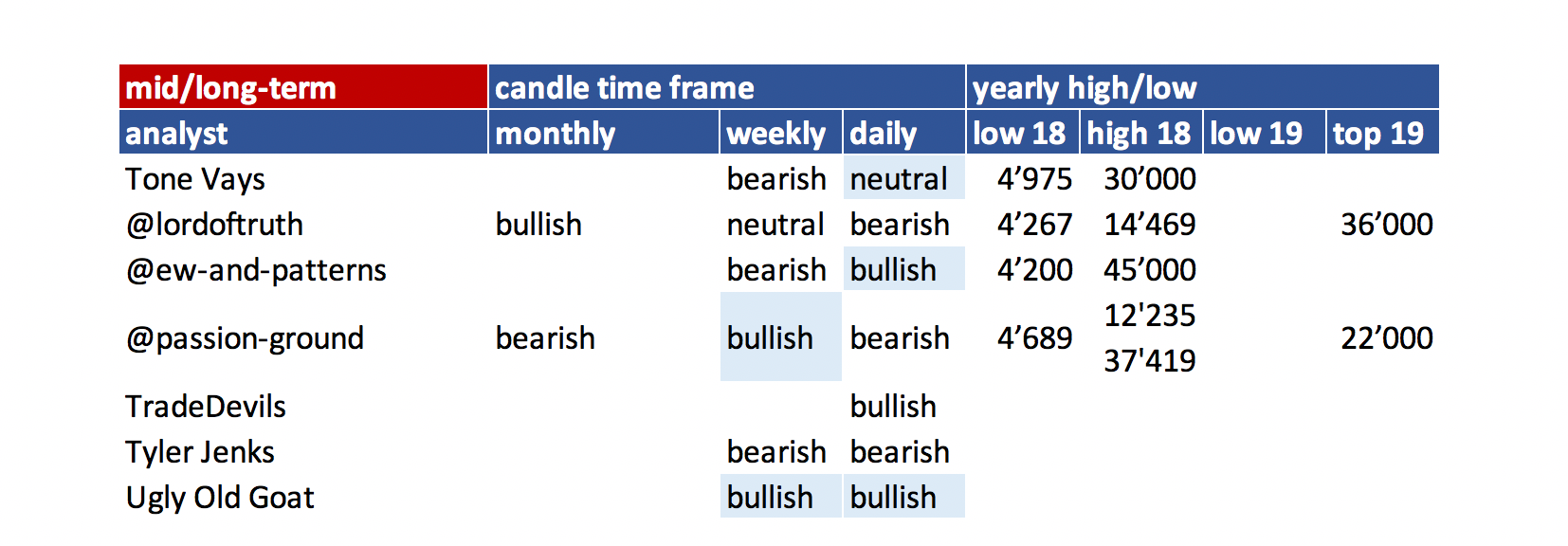

Summary of targets/support/resistance of TAs

Short-term overview

mid- and long-term overview

- please refer to definition section for time-horizon.

- be aware that mid- and long-term is mostly my interpretation of what analysts sentiment is as they not always clearly differentiate those time-frames. To interpret that consistently is very hard so please be kind with my interpretation.

- you can easily spot which analyst did an update(block writing - grey ones don't have an update today).Their changes are in light blue.

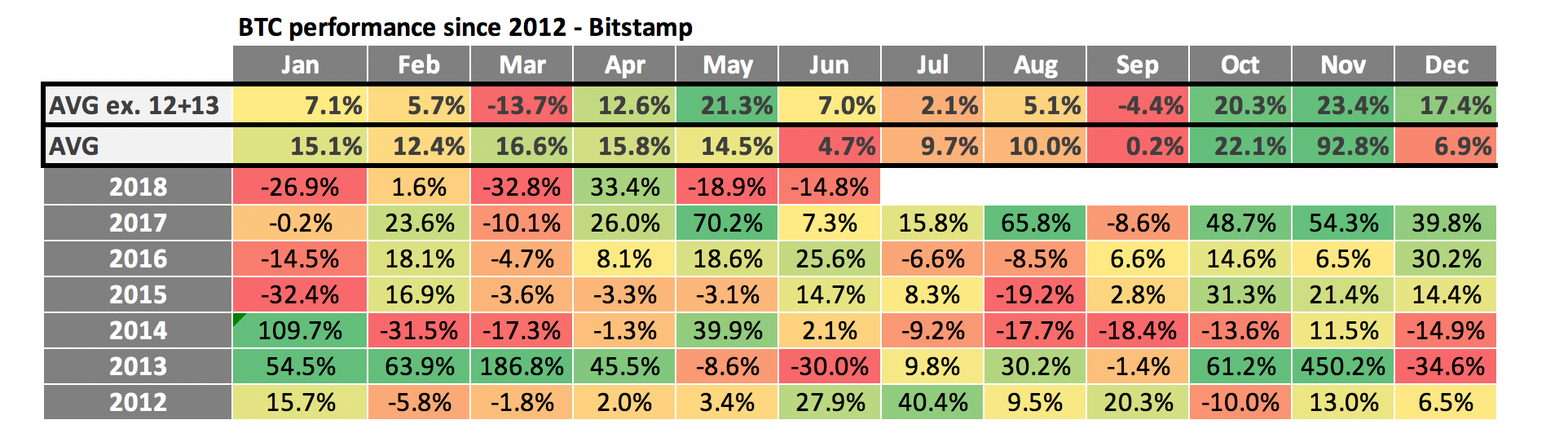

Helpful statistics:

monthly performances

- Added 2012 + 2013 on request.

- As 2012 and 2013 the % move are gigantic I added two averages. One without 2012 + 2013.

- June performance was very weak. With -14.8% clearly below the average of the last years. With 2013 this is the only negative month at all.

- July is a mixed bag - 2 year positive performance and 2 year of negative performance. 2012 and 2013 were positive though.

- The average is positive with 2.1% but that is mainly due to the bull rund 2017. The average incl. 2012and 2013 is even more positive. That is mainly due to the 40%+ spike in 2012 so I wouldn't rely on that.So just looking at this table we probably facing another negative month.

News about the blog

- None

Analysts key statements:

Tone (neutral):

Quarterly chart: We are almost done with 1-4 correction. October / November could be the bottom.

Monthly: Flipped from red to green. That can be good or bad. If next month trades above the current that could be bullish. you need to get above 9'000 be green though.

Short-term outlook:

- Weekly: We are coming on to a death cross. We had a good week which came off the 9. We might pull up to the death cross. Lets see if we make it there - this would be a clean short trade. That should be around end of month or beginning of next week.SAR are taken out - that is bullish. But we had that also in 2014 before reversing.Bollinger band are to far spread for a typically bottom. You want this to be narrow a the bottom.

- Daily: iSHS pattern has been completed. Neckline at 6'800 - the target is 1'000 -> 7'800.We are running into the 128 MA which seems to be very relevant for bitcoin. We might get rejected there.

@lordoftruth (bullish):

Conform 4H, Bitcoin price could be due for a correction from latest rally due to a Profit - Taking and start to show some bearish bias supported by Stochastic negativity, and in the same time RSI indicate that buyers are exhausted, but EMA50 still support the bullish trend.

The reason why we think, that most likely a Pull Back will be in play, towards 6'842 ( the area of interest that buyers are waiting to join ) before the potential continuation of the uptrend.

The bullish trend remain in play unless Breaking 6'842 and holding below it.

Todays trend is bullish. Trading between 7'000 and 7'650.

@ew-and-patterns (bullish):

It is too early to call it a bottom, but I want to show you the best case today. Let's say this impulse wave continues past 8'000 and finally past 10'000...

If so, this is the most probable best case.

It would form a cup pattern, possibly with a handle afterwards.

This move could bring BTC up to 13'200 for wave 1 or X. If it's wave 1, we will likely see any other correction but not a triangle. If it is wave X though, a triangle is very likely due to the rule of pattern alternation. We would have a ZigZag for W, an expanded flat for X and a triangle for wave Y (red).

@passion-ground (neutral):

Here we are, and yet – it still ain’t over till’ it’s over… …the BEAR MARKET that is.

Bearish on the higher level. Next turn month is August.

Daily at his R1 line and gets rejected so far. We are rapidly moving towards RSI overbought.

Weekly - we are moving into a buy signal - long term. We are about breaking out of the downtrend (log chart). We are in a descending triangle and breaking upwards.

TradeDevils (bullish):

He sees lots of positive signs for the bullish case.

Expected that we are correcting towards 7'100 before moving higher towards the 8'300.

Than he expects a bigger correction towards 7'000 area confirming a higher low. That would be very important and supports the bullish case strongly.

If that gets to be true we are probably up to the races towards all time highs. See bigger picture below.

Tyler Jenks (bearish):

SAR has been hit. That is his only point of bullishness.

Bollinger bands are very wide and we are below mid-line. We would need to get above the mid-line and close above 7'780 - to get a bullish signal. If we would get that - we would need to get to the upper bollinger band channel at 9'500 to continue strength.

Volume on weekly is still trending down.

Moving averages (weekly) are moving to the downside. 2 - 7 - 14. We are above short and mid-term. We are above the first two ones but we are below long term and that one is heading down. Also intermediate is still moving down. That signals a neutral to negative chart.

RSI came a bit up - for him that could be interpreted as taking breath for further downside as we have never been oversold. Also we have not gotten back to last peak. He is also not expecting us to.

MACD is getting better "negative" but we are still negative.

He is impressed that the SAR is taken out - but that is his only long term indicator that he is using which is positive. The rest is neutral to negative and he expects this move to slow down and turn soon.

He has positioned itself still in cash and is convinced that he can buy BTC below 5'000 at some time in the future.

UglyOldGoat (bullish):

He sees ether to be in trouble as it rallied agains the USD but not against "sound money" / btc. (own comment: which is true sind mid of January - see chart below).

My own view is that since bitcoin blew through 6'850 and went to 7'600 without allowing anyone on board unless they entered with a buy stop or market order, we should not go back. . . . if this is a legitimate bull. If you followed this Ugly Old Goat you have a Tiger by the Tail. . . and the taking some home by trimming is the wise thing to do.

And if you were brave enough to add to your longs at 6850 at least take that part home and let the balance ride.

If you are long and want to double down or if missed the move and looking to step in, you can by the dip and use a close stop. We might take out the previous days lows, but most likely we just pause here before another leg up. Again, if this is a true bull we have kissed bye bye to 7'000 for a very long time.

Again, these are treacherous markets. We have now gone high enough to get a lot of people bullish. . . some extremely bullish. . . the push seems primarily due to some large trapped short positions, the SEC ETF ruling coming on August 10 and the flight to safety by wise eth holders. The general public has yet to catch on as the eth dollar price rallied slightly. When this reverses look out below for eth.

Will the eth collapse continue to rally bitcoin? Probably, so long as it collapses relative to btc. But when eth collapses in fiat dollar price this could reek enough havoc to bring a short lived collapse in bitcoin, which is the healthiest scenario in the long run. (The Perfect Storm)

Personally, I believe eth will go under .03 btc before btc goes under 5'000. This is simply the dawn of the ExTHit. . . a catastrophe waiting to happen.

IT's time to pull the trigger

The basis, relative strength, the timing indicators all say it is time to pull the trigger and risk 1st and 2nd quarter lows. Yes, if we break it will be hard but that is fear. . . everything else says this is a low risk time and place to be a buyer.

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 18. July | here |

| @lordoftruth | 19. July | here |

| @ew-and-patterns | 18. July | here |

| @passion-ground | 18. July | here |

| @tradedevil | 18. July | here |

| Tyler Jenks | 18. July | here |

| UglyOldGoat | 19. July | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely). The sentiment is based on 4hr, daily, weekly, monthly candle charts.

- The forecast time horizon of candles can be compared with approx. 4hr = 1-2 days; daily = 4-14 days; weekly = 4 - 14 weeks; monthly = 4 - 14 month.

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

Educational links:

- From @ToneVays: Learning trading

- From @lordoftruth: Fibonacci Retracement

- From UglyOldGoat: How to achieve the same results of a professional trader without taking the inherent risks

- From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here. In addition he has an online course which you can find here

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.

0 comments:

Post a Comment