Bitcoin is staging a run. The last couple weeks saw it bounce from the lows and now tops $8,000. Everyone is wondering is this the beginning for a new bull run or just a jump off the low before resuming the downward move.

If this does signal a reversal, how long until we see calls that Bitcoin is in a bubble? There are many out there who like to slam Bitcoin claiming it is overvalued and "bubbling". It will not take much of a move for those people to start the call again.

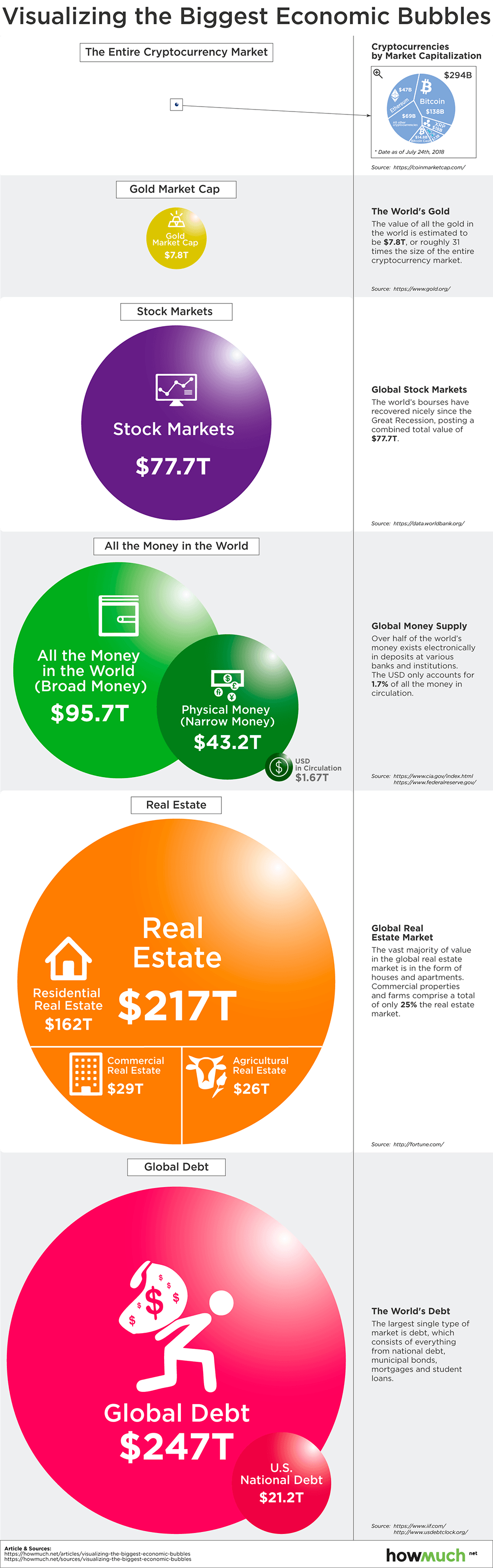

The world of money is enormous. So, too, is the world of assets. Bitcoin and the entire cryptocurrency market is minute compared to the other asset classes. This is a vital point for people to remember as the calls for bubble start raining down from the rafters.

Here is a visualization that should put the different markets into perspective.

The gold market is long considered to be a minor investment vehicle which is use primarily as a hedge or by those who have a view of impending financial doom. These people tend to be anti-fiat believing that the only true "money" is that backed by gold. It is often a part of portfolios but rarely does it make up a major percentage of one's holdings.

Looking at the chart, we see this market is 7T, much larger than the 300B that the entire cryptocurrency market rings in at. The findings get exaggerated even more when looking at the total money supply, stocks, and real estate. Compared to these markets, cryptocurrency is the equivelant to a rounding error.

This chart shows that all calls for a cryptocurrency bubble will be pre-mature. There is a lot of room for growth before this asset class is anywhere close to a legitimate player. This means that the idea of it bubbling, especially so early in the development, is misguided.

The ebb and flow of markets are natural. Bubbles, however, are a different story. If one wants to watch for bubbles, the other asset classes could be more likely candidates. They had a much bigger run than Bitcoin and cryptocurrencies.

0 comments:

Post a Comment