To avoid unnecessary losses on cryptocurrency trading, it can be a very good idea to set a Stop-Limit order on the exchange you're trading on. This post serves as a short guide and how-to explanation of how to set up a Stop-Limit order on the Binance Exchange.

Most people begin with trading Market ordersor by setting Limit Orders where you can buy for market price or set up a specific price at which you're interested in buying or selling. A recently added extra feature is that of the Stop-Loss or Stop-Limit feature. The wording differs between exchanges, but Binance calls this feature a Stop-Limit order.

What is a Stop-Limit order

A Stop-Limit order will let you create a certain order which will only trigger when a certain price is met. For example, if you have recently bought into a new cryptocurrency and it's price goes up by 20% and you want to 'lock in' some profits you can set up a Stop-Limit order at 15% profit, which is 5% less than where it currently is at. If the price should then fall back down below the 15% profit threshold that you set, your Sell Limit Order will be placed on the Order book and trigger to avoid losing more of your profits. The 15% threshold that you created with the Stop-Limit order prevents you from that.

Similarly, if you just bought in and want to protect your investment, you may set a Stop Limit order just below your buy-in price so that if the price should fall you can mitigate the damage and keep your losses to a minimum.

Stop-Limit on Binance

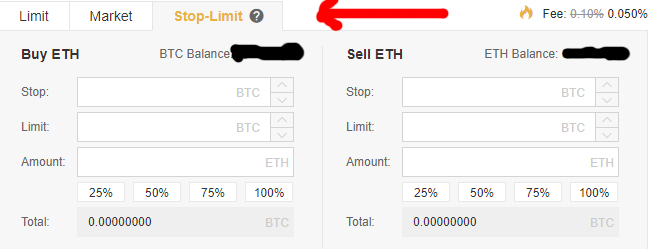

On the Binance Exchange you can find the option for the Stop Limit order on the Tab illustrated below. It will take you to the screen shown on the picture below:

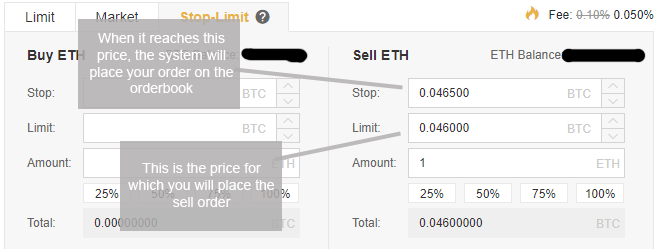

There are three parameters that we need to enter:

- The 'Stop' price

- The 'Limit' price

- The amount of tokens we want to sell

For the Stop Price: Under Stop price we enter the price at which we want our Limit order to appear on the orderbook.

For the Limit Price: Under Limit price we enter the price at which we actually want to sell our token.

For Amount: For amount, we simply enter how many tokens we wish to sell.

The Stop-limit order allows for a lot of flexibility. You can also use the same mechanism to buy. Perhaps you are waiting for a crypto to break out of a channel. You could then identify at which price you consider it a buying opportunity, and then set a buy price at the break-out level. Similarly, if your investment trends downward you can automatically react to it through the Stop Loss.

For newcomers it can be hard to figure out what to enter in each field for the Stop-Limit order, and so I made this short guide in the hopes that it will help somebody out and make it a little more clear.

Especially with Bitcoin going up and down it is usually quite easy to recognize critical support levels. When the BTC value goes down, Stop-Limit orders let you sell when the support breaks and buy back in at a lower support at the same time.

Donate::

BTC:1LpjDuu3jzJivUX8ejNJXHaxPzdhKBWDZD

ETH:0x5eb2EBc0DD9b2570Fea8e11a7d3fdD166FbfD0D0

BCH:qrvhztuwfw8eql4xswkfh7w6m32mamhdgu2ndflv2a

Donate::

BTC:1LpjDuu3jzJivUX8ejNJXHaxPzdhKBWDZD

ETH:0x5eb2EBc0DD9b2570Fea8e11a7d3fdD166FbfD0D0

BCH:qrvhztuwfw8eql4xswkfh7w6m32mamhdgu2ndflv2a

0 comments:

Post a Comment